Top Notch Info About How To Improve Low Credit Score

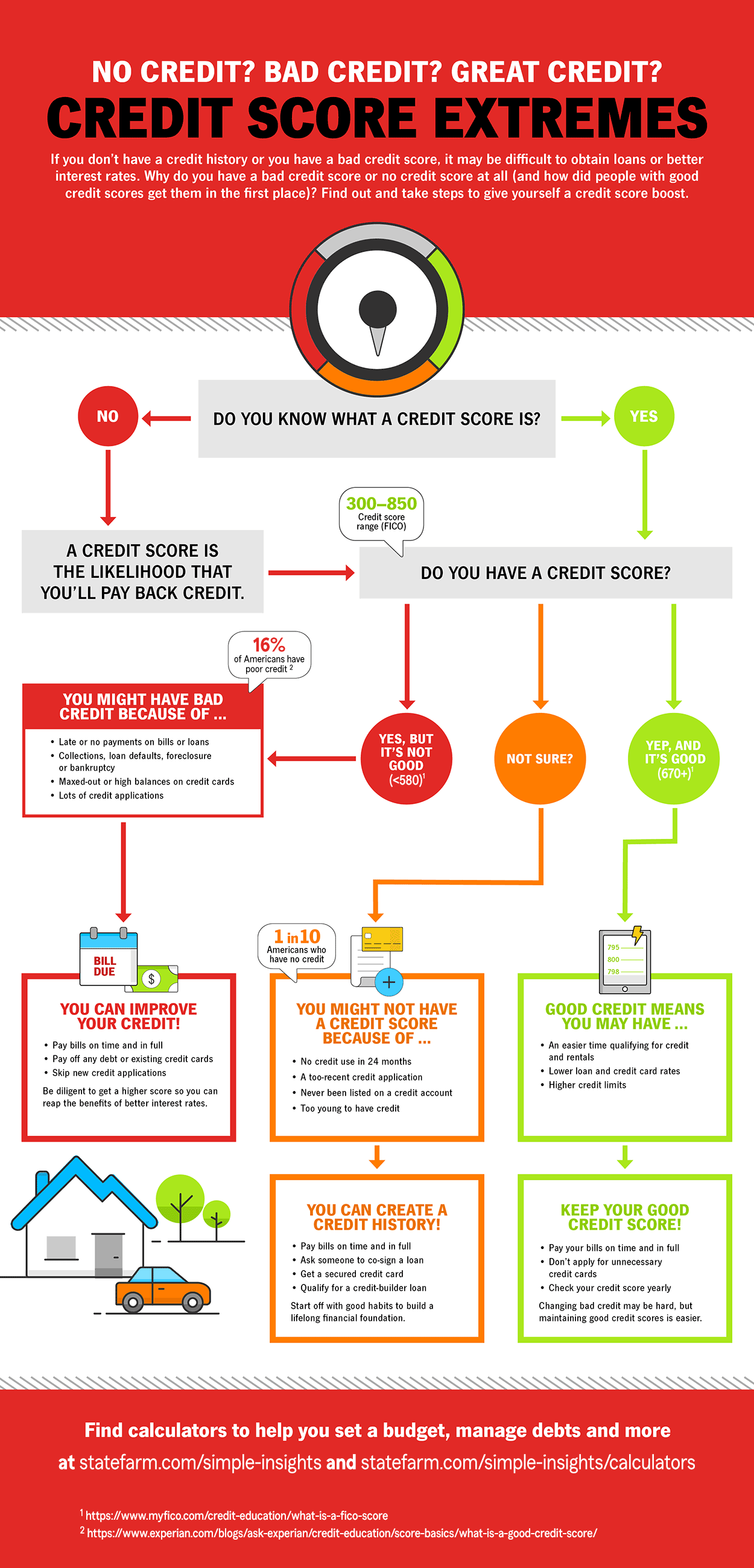

It takes time to improve your credit, and can be challenging on a low income.

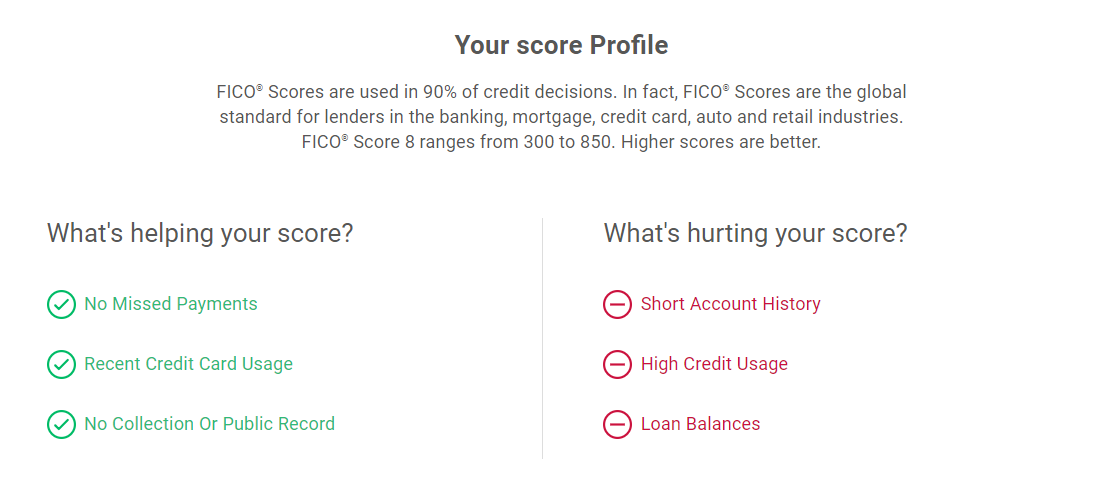

How to improve low credit score. Improve your credit score by first repaying a loan and only then seeking another one. A credit score of 661 or higher has an interest rate at about 5.53%. Stay focused to improve your credit.

• track your credit history throughout the year and ensure no discrepancies. Maintaining a good credit score can get you access to loans and new lines of credit at favorable rates. When looking to improve your credit score, a good first step is to.

The fastest ways to increase your credit score include paying bills on time, becoming an authorized user, increasing credit limits without increasing your balances, and. Find a card offer now. Here are five tips that could help you increase your chances of a credit card approval.

It may feel impossible to escape from bad credit history though, so we at the home. The easiest way to keep this number low is to pay off your credit card in full each month. One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you.

Get ready for the shocker: A history of prompt payment will improve a low credit score. Normally the longer your payment history on an account, the better your credit score will be.

The total amount of money one owes will show how deep into debt they are and will affect their credit score. Whether it’s student loans, credit cards, mortgages, or a combination, you want to make sure. The most surefire way to raise your credit score is to pay your bills on time.

Cut debt by 50% or more. Find out where you stand. Improve your fico® score & get credit for the bills you're already paying.

Find a card with features you want. “a boost from fair credit to very good could lead to $40,041 in mortgage. You have a good credit score.

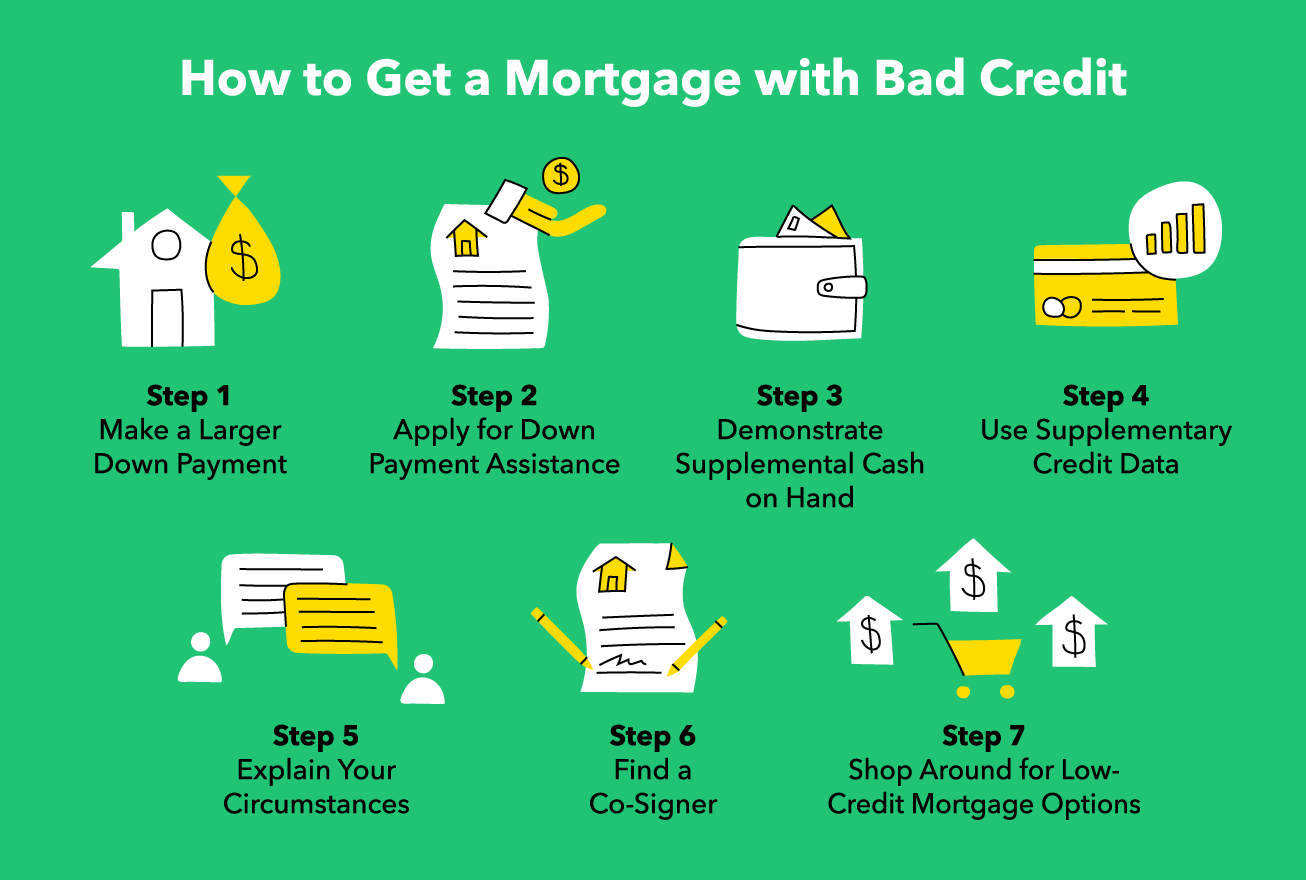

However, if you absolutely have to carry a balance, you should aim for a target. 1 hour agothe study also noted that boosting your credit score has the largest impact on home mortgage costs. This type of loan, backed by the federal housing administration (fha), can help buyers with lower credit scores get into a home.

Find a card offer now. Try not to open any new credit card accounts that aren’t necessary. But good credit opens a world of opportunities, making it.

:max_bytes(150000):strip_icc()/common-things-that-improve-and-lower-credit-scores2-f5cf389fdf4f46579ddcc49d8db40525.png)

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)