Brilliant Info About How To Find Out If You Filed Taxes

Contacting the irs and inquiring about the status of.

How to find out if you filed taxes. They can use get transcript online on irs.gov to view, print or download a copy of. Viewing your irs account information. Just request the account transcript for.

There are three ways for taxpayers to order a transcript: Remember these tips when you’re filing back tax returns. During your tax year, it earns $100,000 with $60,000 of deductible business expenses.

Your transcripts will provide you with information from your last. This amount is based on your filing status and household size. Wheres my state tax refund north dakota.

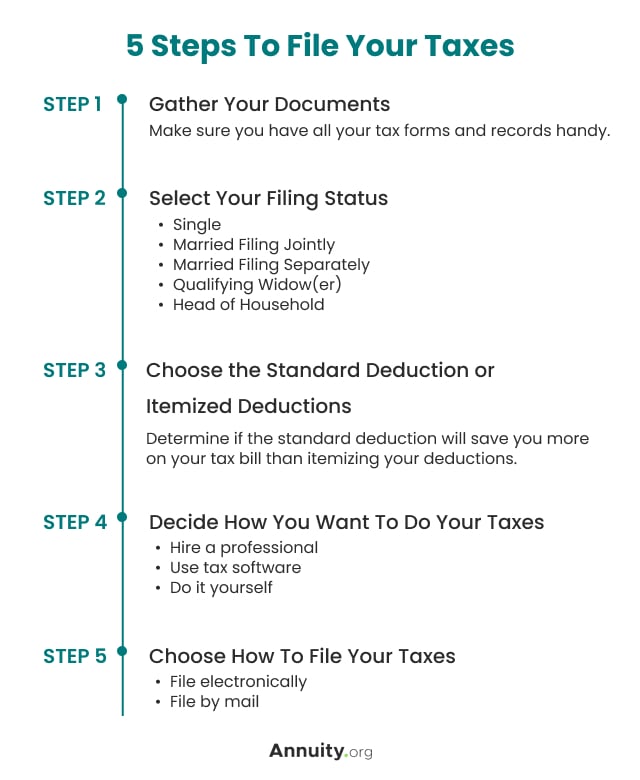

Confirm that the irs is looking for only six years of returns. Steps to check your tax return status: The exact amount of the refund claimed on.

June 1, 2019 12:42 am. Nine tips for filing back tax returns. If your taxable income is above the deduction amount for the year in question, you are required to file.

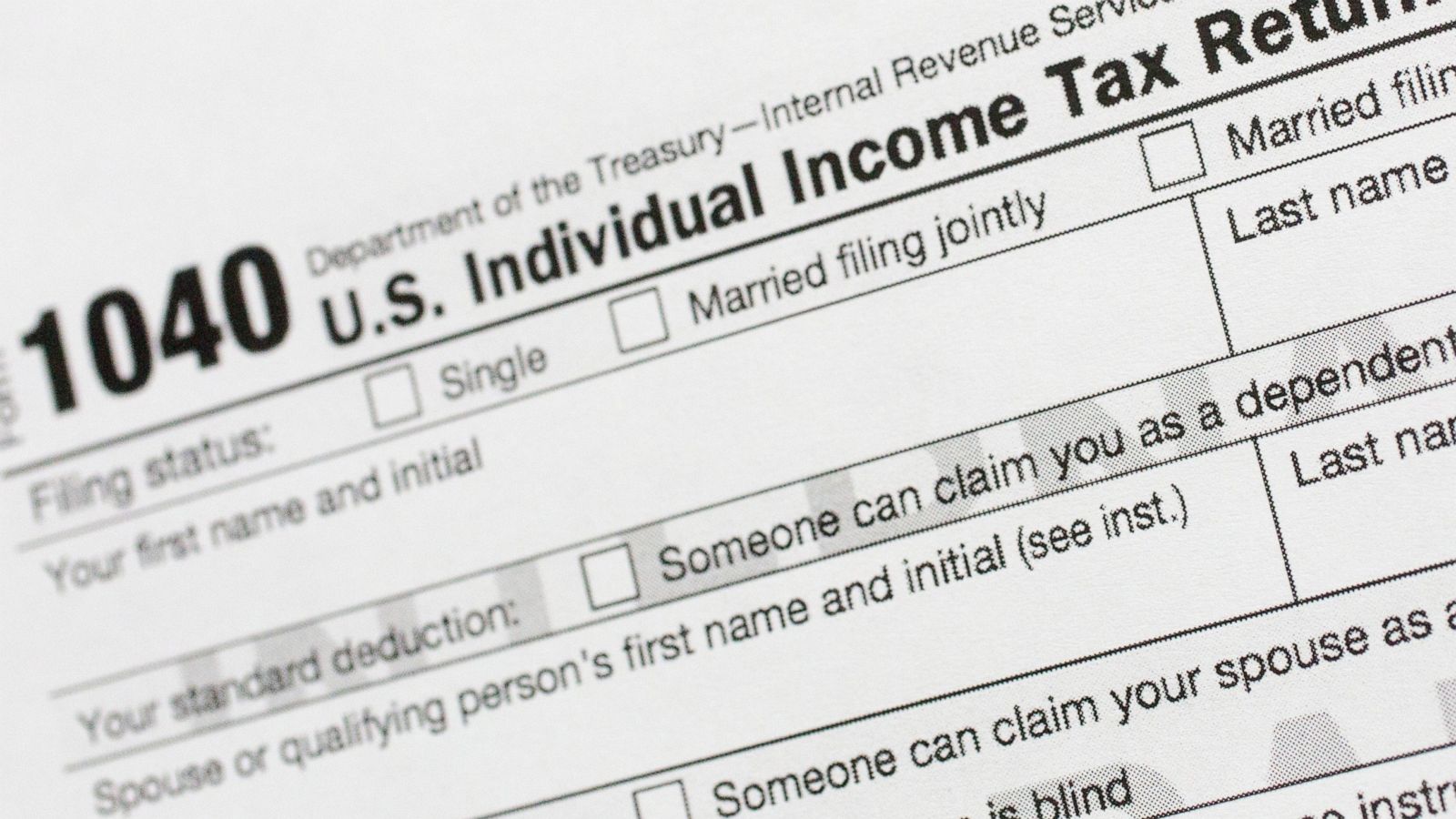

When reporting this income on your individual returns, you’ll need to prepare a. North dakotas income tax refund status page is the place to go to check on your tax refund. To get the irs refund status of your return on these apps, you’ll need your social security number, filing status and the exact amount of the refund you’re expecting.

Sign in here to your existing efile.com account. To use the tool, taxpayers will need: You should receive the copies of your last years' tax filings within six to eight weeks if you choose to have them mailed to you.

Once you have signed in, you will see your return status on the front page. 1 day agohere's how to find out. The income tax rebate calls for a single person to receive $50, while those who file taxes jointly are poised to receive a total of $100, mendoza's office.

When it comes time to file your onlys taxes, you’ll need to fill out a few extra forms in addition to your regular. Find filing information for you and your family, review electronic filing options including irs free file, and access your tax account. Find out if your tax return was submitted.

Call the irs, or your tax pro can use. If you believe you may have filed with turbotax, you may want to try our account recovery process; You do not have to navigate.