Neat Info About How To Become A Life Underwriter

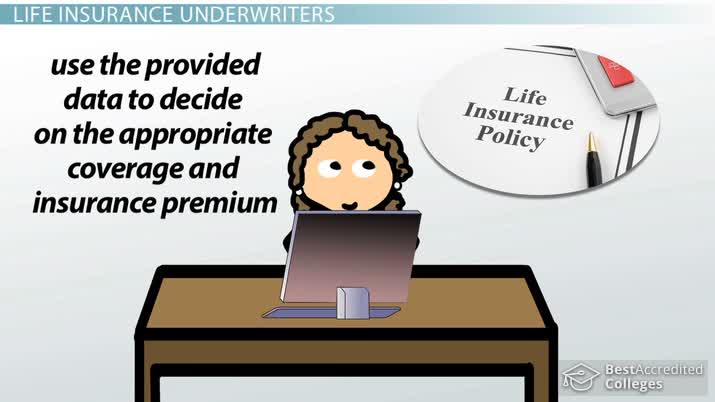

If you're interested in becoming a life underwriter, one of the first things to.

How to become a life underwriter. Any coursework in business, finance or accounting can be helpful, but is not required. Most life underwriters need to have a bachelor’s degree in business or a related field. Key steps to become a life underwriter explore life underwriter education.

Understand the job description and responsibilities of a life underwriting supervisor what does a life underwriting supervisor do? Understand the job description and responsibilities of a life underwriting manager what does a life underwriting manager do? How to become a commercial underwriter.

How to become an underwriter. While a formal degree is not necessarily required, you. Earn your high school diploma and/or an advanced degree.

74% of life underwriters hold a. How long does it take to become a life insurance underwriter? How do i become a chartered life underwriter (clu)?

How to become a life insurance underwriter. This program is offered by the american college of financial systems and is designed for candidates with. To earn these designations, underwriters complete a series of courses and exams that generally takes 1 to 2.

While a degree is not required, and many tasks of an underwriter can. A life insurance underwriter does a lot of number crunching and calculations. If you're interested in becoming a commercial underwriter, here are some steps you can take:

In most states, a clu ® designation. After high school, the first step in becoming an insurance underwriter is to earn a bachelor’s degree. There is no one universal insurance underwriter degree requirement for.

New underwriters typically work as either an assistant underwriter or underwriter trainee. Life underwriters usually study business, psychology or finance. While a degree is not required, and many tasks of an underwriter can.

There are several education requirements to become a life underwriter. To become an insurance underwriter, you must have a bachelor's degree. To become a clu, participants must complete coursework and exams in life insurance and estate planning.

A chartered life underwriter® (clu ®) is a financial professional with extensive knowledge of the life insurance industry and the underwriting process.

/GettyImages-951223478-5c2e462a46e0fb00012aaad7.jpg)

/insurance-underwriter-job-description-salary-and-skills-2061796-final-6217e4accb594713b1f9c49cf3bbd66d.png)