One Of The Best Info About How To Build Credit With A Secured Card

Enjoy our quicksilver® secured or platinum secured card—no hidden fees.

How to build credit with a secured credit card. Choose the right card for you. Set up autopay for your monthly bills, including those for credit cards. Keep the following in mind:

Don’t choose just any secured credit card. #buildingcredit #creditcards #creditbuilding 1 easy way to start building your credit 1 easy way to start building your credit1. The length of your credit file:

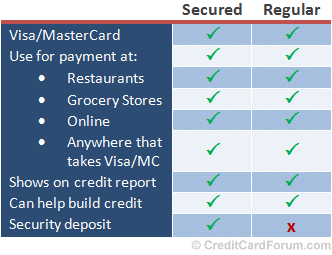

The deposit is usually equal to the credit limit on the card. Furthermore, secure credit cards are called that because you need to pay a security deposit when you apply. Sending the money using your bank’s online bill payment tool.

How credit cards are supposed. Ad get access to the credit you need with a refundable secured card deposit—apply today. A secured credit card is backed by collateral, so they are available to borrowers with low scores.

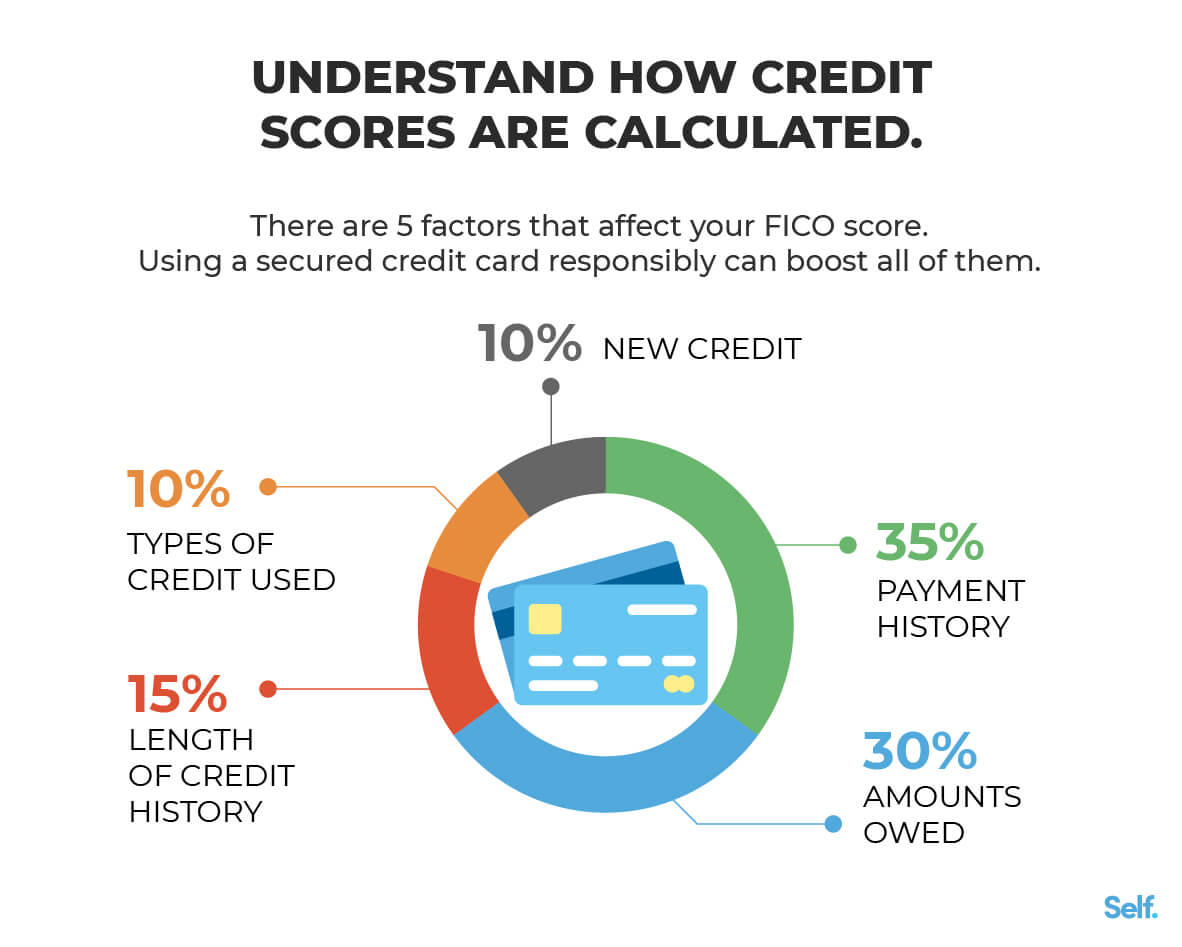

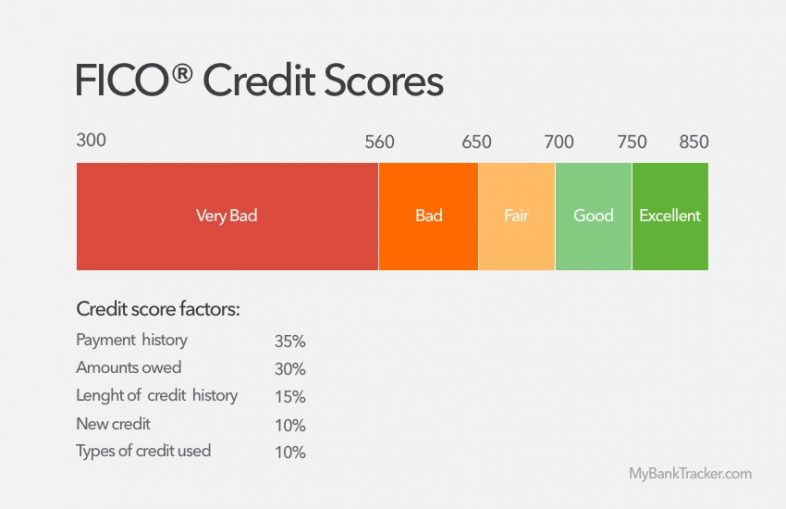

They are no risk to the issuing bank. Enjoy our quicksilver® secured or platinum secured card—no hidden fees. So, if your secured credit card has a credit limit of $500, you’re going to want to keep your outstanding balance below $150, which is 30% of $500.

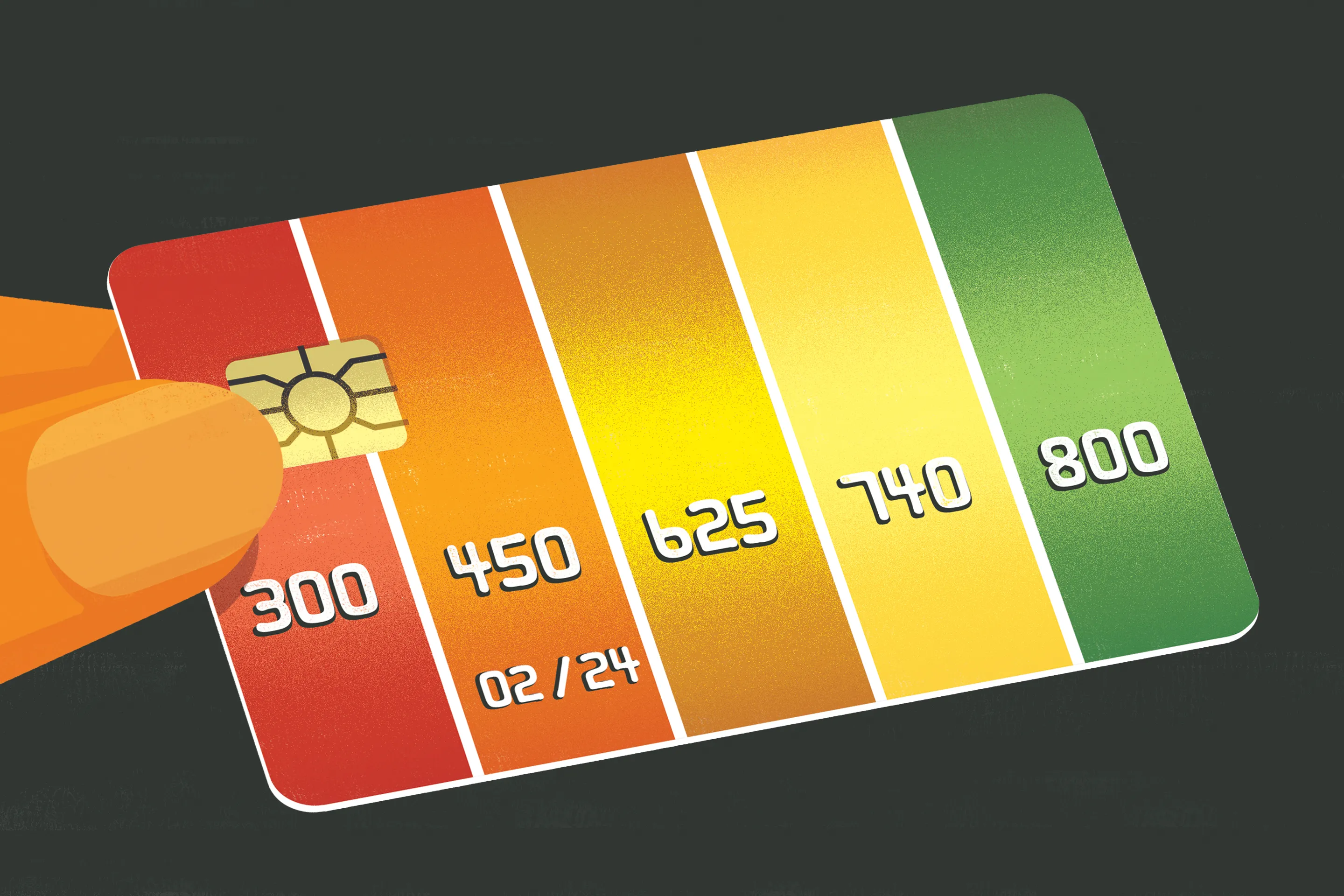

Secured credit cards allow you to build credit relatively quickly. And since the credit limits are on the low side,. Ad grow your score by average of 30 points* with the secured credit builder visa® credit card.

1.5% cash back on everything. Low interest secured credit cards. Like unsecured credit cards, secured credit cards come with unique benefits and.

Apply for a secured credit card when selecting a secured credit card, you should first choose the card that works for you. Fill out a secure online application. The two most important factors in your fico credit score are your payment history and your credit utilization.

Get approved and start building your credit. Let us walk you through some of the tips that you can use to improve or build your credit score: Secured chime credit builder visa® credit card issued by stride bank n.a., member fdic.

Ad no annual fee secured credit cards. If you were denied a secured credit card, the company issuing the card or the lender should have sent you a written notice outlining why. See your credit score directly in the app.

:max_bytes(150000):strip_icc()/dotdash-secured-vs-student-credit-cards-which-to-choose-5190814-Final-78ffa1b9aa5d47028994ff6d47518a2b.jpg)