Perfect Tips About How To Lower Your Apr

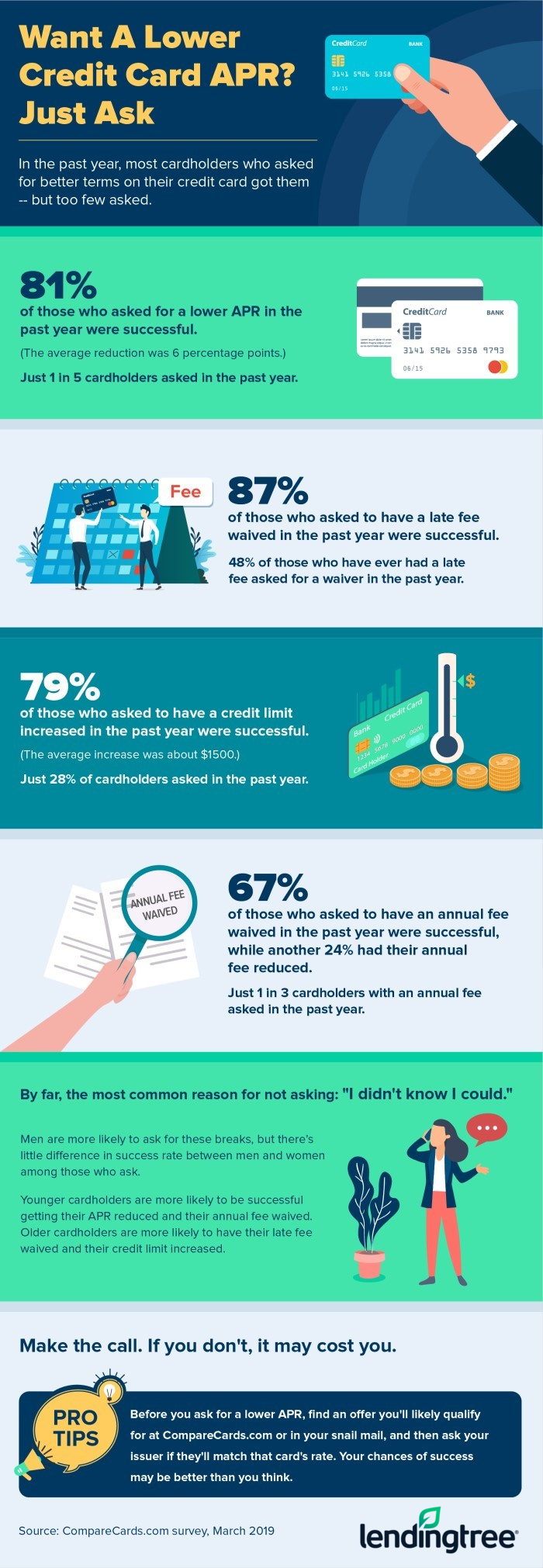

Most credit card companies are very competitive, and customers hold more power than they might think.

How to lower your apr. Maintain a good credit score keep track of your credit score regularly and. One thing is for sure, us humans are instant gratification entitlement. A good course of action is to.

Your credit card company won't lower your apr just because you've been taking care of your credit; The way your interest is calculated by using your apr is: An unconventional, yet effective, way to lower your credit card debt.

You have the best chances if. Follow these guidelines before and during the loan or refinance process to get the lowest apr possible for you. This will help you to pay off the current loan with the high interest rate, and then only pay on the.

Because your credit score can be a factor in. Take an inventory of your financial health and credit standing. What rate hikes cost you.

You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a. How to lower your credit card interest rate 1. Take your apr and divide it by 12 (12 months in a year) and.

One way to pay less in interest for a limited time is to apply for a balance transfer credit card, most of which let you secure a 0 percent intro apr on transferred balances for 12. There are several techniques to help you rethink how you. You need to call them and ask them to lower your apr!

While it is always best to pay off your credit card balance in full or as. They can be if you don’t use them wisely though. By expressing in a nonconfrontational but direct manner that you'd like the company's help to keep you as a customer, there's a good chance it will grant your request and.

You’ll have the best chances of scoring a lower apr if you’ve had your card for a few years. You can lower your apr by securing a loan through your home equity line of credit. Negotiating a lower apr for your mortgage, car loan, or other personal loan will likely take the route of refinancing instead of simply asking for a reduction.

Some credit card issuers have hardship plans that may temporarily lower your apr or minimum payments. How to lower your current apr review your payment history. How to best leverage intro 0% apr offers.

Okay, back on track now. Guy lowers his apr by 5.75% using my negotiation scripts ramit sethi | may 13, 2009 i’ve said it before and i’ll say it again: 9 strategies you control to lower your car loan apr 1) be patient and don't rush into a car loan.