Casual Info About How To Increase Your Credit Score By 100 Points

Your payment history contributes to about 35% of the credit score.

How to increase your credit score by 100 points. The fastest ways to raise your credit. The steps required to improve credit can vary from person to person. Checking your credit score does not impact it in any way.

Credit card balances can have a significant negative impact on a consumer’s credit scores, and are a good place to start to raise your credit score. How to build your credit, how to raise credit score 100. Start building your credit with build.

Ideally, 10% will give you the best results. Raising credit by 100 points, increase credit score 100. While some may apply to you, others may not.

I lowered my credit utilization ratio by 19%! There are ways you might be able to instantly improve your credit score, but it’s unlikely that your credit score will increase by 100 points. Here are some of the most helpful and useful tips to increase your credit score:

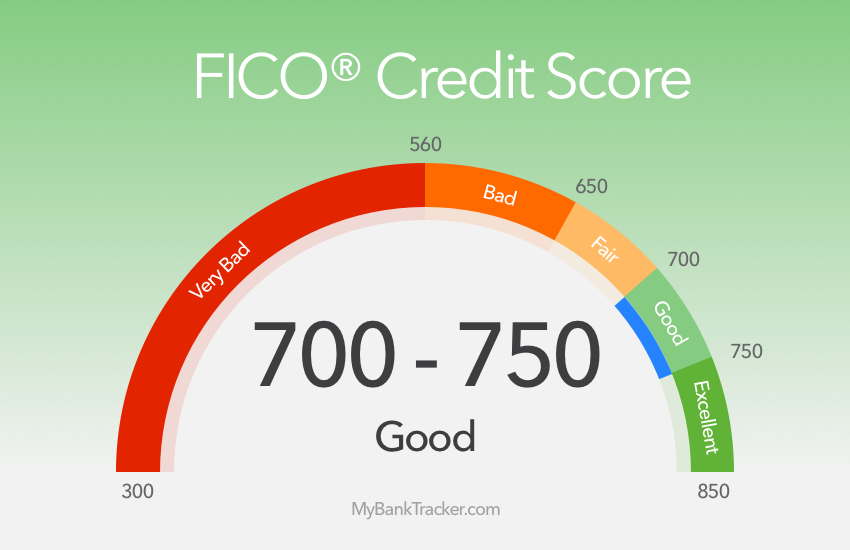

Nearly 30% of the points in your fico and. You want a debt to credit ratio of less than 30%. Because many things affect your credit score, you will also find various ways to improve it.

I started making extra payments to all my debts. You have an 80% debt to credit ratio. Closing an account or getting a credit limit increase will change the amount of your total credit, thus affecting your credit utilization percentage.

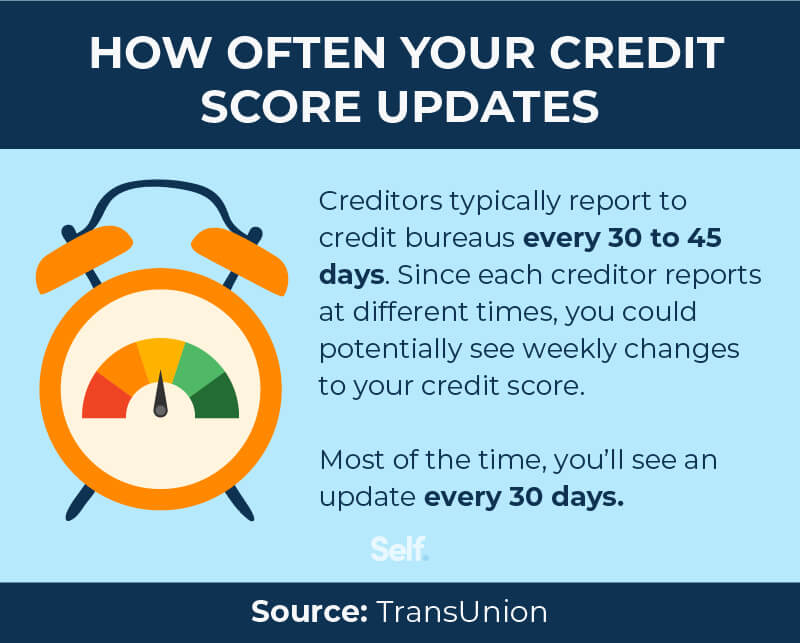

Choose from multiple options and enjoy predictable payments you can budget for. If that doesn't apply to you, a reality check is in order. If you prefer, you are entitled to one free credit report every year from transunion and equifax.

I’ve determined these seven easy steps can help you increase credit score by 100 points in canada within a short time frame. Payment history & credit use can improve your credit score. Find a card offer now.

Credit scores rise and fall based on the contents of your credit report, so adding positive information to your report will offset negative entries and increase your score. To increase your credit score, the balance of each personal credit card or line of credit account should be thirty percent or less. 6) keep your oldest cards open.

The major contributing factor to improving my credit score in just 30 days was decreasing my credit utilization ratio. If you’re concerned with your financial health, here’s. Good payment history can help improve your credit score by 100 points.

![How To Raise Your Credit Score 100 Points Overnight [2022]](https://themillennialmoneywoman.com/wp-content/uploads/2020/10/strategies-to-improve-credit-score.png)

![How To Raise Your Credit Score 100 Points Overnight [2022]](https://themillennialmoneywoman.com/wp-content/uploads/2020/10/what-is-a-good-credit-score-768x576.png)