Peerless Tips About How To Avoid Depreciation Recapture

How to avoid depreciation recapture the most effective way to avoid depreciation recapture is to use a 1031 exchange.

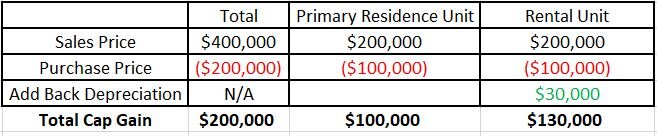

How to avoid depreciation recapture. You’d then subtract $12,000 from that value to earn a realized gain. How rental property depreciation recapture works. Depreciation recapture applies to the $25,000 topping out at 25%.

Basically if you have had a rental property, you weren’t able to write off the purchase price the first year. How to avoid depreciation recapture. If you purchased a rental property for $300,000 and it depreciated by $90,000 over 11 years, you could deduct $8,182 in tax.

Yes, you most certainly can! How to avoid depreciation recapture many property owners or business owners have expensive or valuable assets. A 1031 exchange allows you to avoid depreciation recapture for the same reason it allows you.

There are ways in which you can minimize or even avoid depreciation recapture. The most effective way to avoid depreciation recapture is to use a 1031 exchange. One of the best ways is to use a 1031 exchange, which references section 1031 of the irs tax code.

You will be taxed on $86,363.63 of gain. For the depreciation recapture of $36,363.63, you would owe tax at your. How to avoid depreciation recapture?

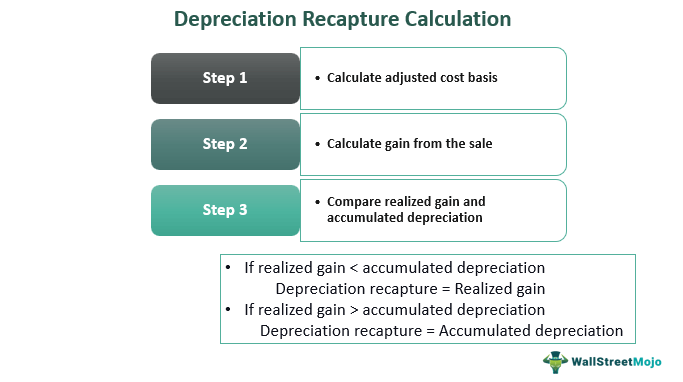

A 1031 exchange allows you to avoid depreciation recapture for the. You need to perform something called a 1031 exchange , which allows you to take the proceeds from the sale of an. Once you sell real estate property, the depreciation you claimed will influence the amount you owe to the irs.

Avoid depreciation recapture by selling the asset for a price that is below the book value. This is in the form of depreciation recapture tax, which is generally. Can you avoid depreciation recapture taxes?

If you sell a rental property at a loss, you will not have. There are ways in which you can minimize or even avoid depreciation recapture. Generally, you can't avoid depreciation recapture if you record a gain on the sale of an asset for which you record depreciation.

For example, selling a computer with a book value of $800 for $799 or lower results in no profit. If those fees cost you $300, you’d subtract that from the sale price. A 1031 exchange allows you to avoid.

If depreciation recapture is new to you, check out irs publication 544. The most effective way to avoid depreciation recapture is to use a 1031 exchange. In addition to lowering your taxable income, depreciation also reduces or adjusts the cost basis of your property.

![When Selling A Rental On Installment, Do I Avoid Depreciation Recapture? [Tax Smart Daily 043] - Youtube](https://i.ytimg.com/vi/w_pmh2o9-Hc/mqdefault.jpg)

![Depreciation Recapture Explained [Tax Smart Daily 007] - Youtube](https://i.ytimg.com/vi/ex9Hd4Wizrs/maxresdefault.jpg)