Outstanding Info About How To Avoid Credit Debt

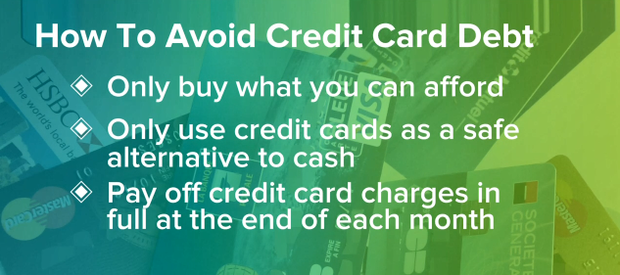

Here are some ways to reduce your credit card interest charges:

How to avoid credit debt. If you want to charge something. It may sound trite, but the best way to avoid credit card debt is not to accrue any in the first place, which means paying off your balance in full every month. Choose a debt payoff strategy to lower your balance and your interest charges.

Accc offers seven tips on how to avoid debt: To avoid going into credit card debt, you first need to make sure that you have a safety net in place. Avoid the special services, programs, and goods that credit card lenders offer to the bill to their cards.

Set your monthly spending limits. How to avoid 10 habits of credit card debt: Using your credit card must figure into your.

Paying on time will help keep your interest rates low and may even. One of the simplest ways to avoid credit card debt is always to make sure that you pay your balance on time. When you don’t have access.

Have at least three months of living expenses saved up in case of an emergency. Make sure you base that figure on what your bank account shows you can afford. Don’t carry a credit card balance.

However, you have to a lot some resources to pay for credit debts to avoid additional interest, more interest, and a low credit score. This is one of the most effective ways to avoid credit card debt. The best way to avoid credit card debt is by creating a monthly budget.

Set your monthly spending limits. Understand all the terms before opening a new credit card. 10 best ways to avoid credit card debt 1.

How to avoid credit card debt methods 1 practicing financial responsibility 2 signing up for a credit card 3 using your credit card responsibly other sections expert q&a.

:max_bytes(150000):strip_icc()/170886185-56a1dec83df78cf7726f5da6.jpg)